How To Generate Payslip?

A payslip, also known as a paycheck stub, is a document provided by an employer to an employee, detailing the employee's earnings and deductions for a specific pay period. It serves as a record of the employee's salary, taxes withheld, and any other deductions or additions to their pay, such as bonuses or reimbursements. Payslips are essential for both employers and employees, as they provide transparency and accountability regarding compensation and ensure compliance with labor regulations.

To generate a payslip, follow these steps

Add CTC Value in Employee Form

Ensure that the Cost to Company (CTC) value is added in the Employee form, as it serves as the basis for calculating the employee's salary.

Set Salary in Salary Module

Navigate to the Salary module and click on "View Employee Details."

Add payments such as medical expenses, bonus, basic payment, etc., as per the employee's entitlement.

Similarly, add deductions such as TDS, professional tax, etc., based on the company's requirements.

You can edit or delete the payments and deductions as needed.

Generate Payroll

After setting the salary components, generate the payroll following the steps outlined in the previous explanation.

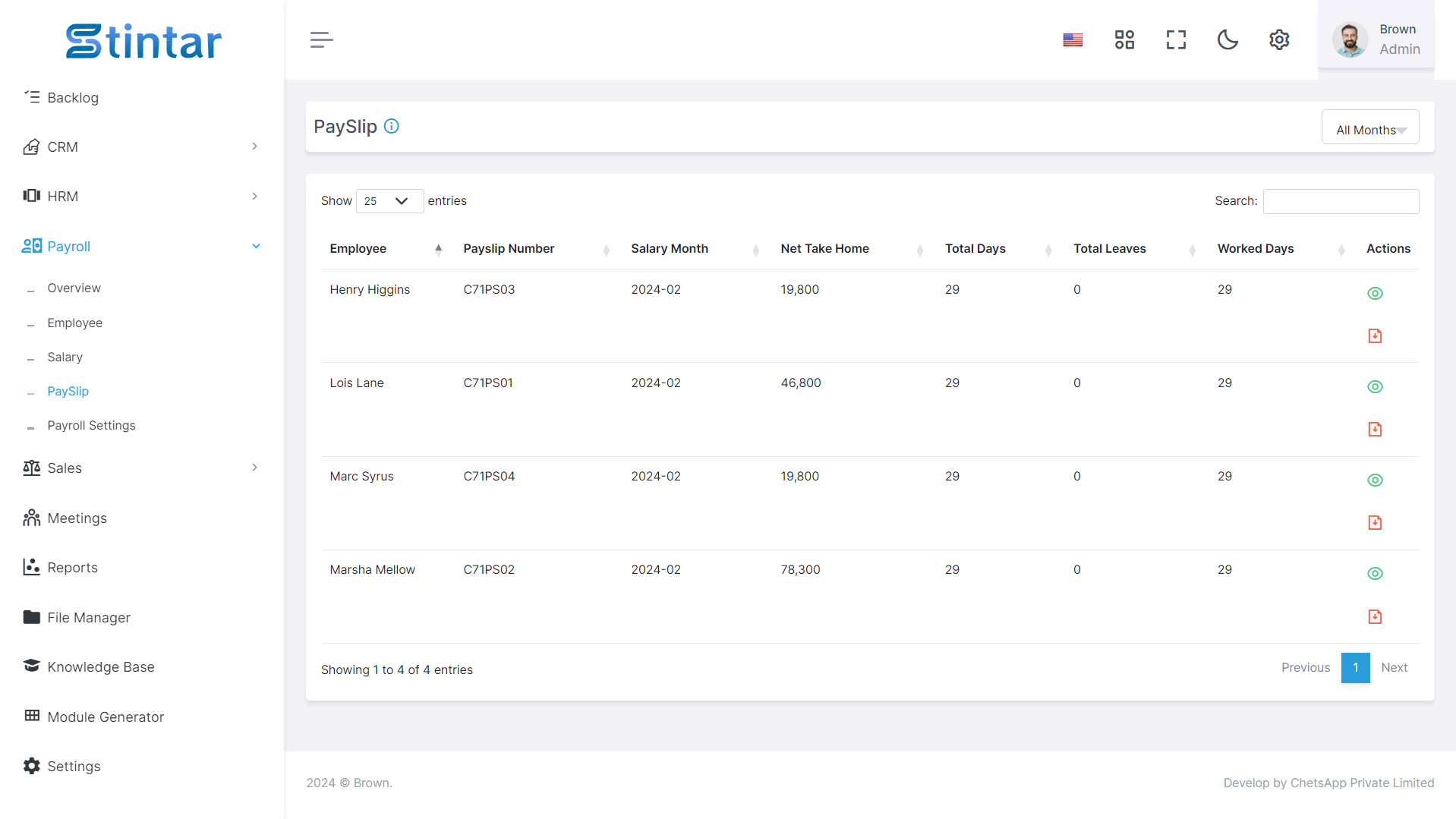

Navigate to Payslip Module

Once the payroll is generated, navigate to the Payslip Module.

View and Edit Payslip

Tap on the view icon to preview the payslip.

Make any necessary changes or adjustments to the payslip as required.

Finalize and Download

Once the payslip is finalized, download it in PDF format for distribution to the employee.

By following these steps, you can efficiently generate and distribute payslips to your employees, ensuring accurate and transparent recordkeeping of their earnings and deductions.