How To Create A Tax?

Creating taxes is essential for accurately calculating and applying taxes to transactions within your sales module. This guide provides clear steps to create taxes, enabling you to streamline your taxation process and ensure compliance with applicable tax regulations.

Create Tax

Accessing the Tax Section

Open the Sales Module of your system.

Navigate to the tax section, typically located in the main menu.

Initiating Tax Creation

Within the tax section, look for the "+ Create" button to begin creating a new tax.

Click on the button to access the tax creation form.

Filling the Tax Creation Form

Name

Enter a descriptive name for the tax, such as "Sales Tax", “GST”, or "VAT."

Rate

Specify the tax rate as a percentage (e.g., 10% for a 10% tax rate).

Saving the Tax

Review the tax details for accuracy.

Click on the "Create" button to add the tax to the system.

Review the tax details for accuracy.

Click on the "Create" button to add the tax to the system.

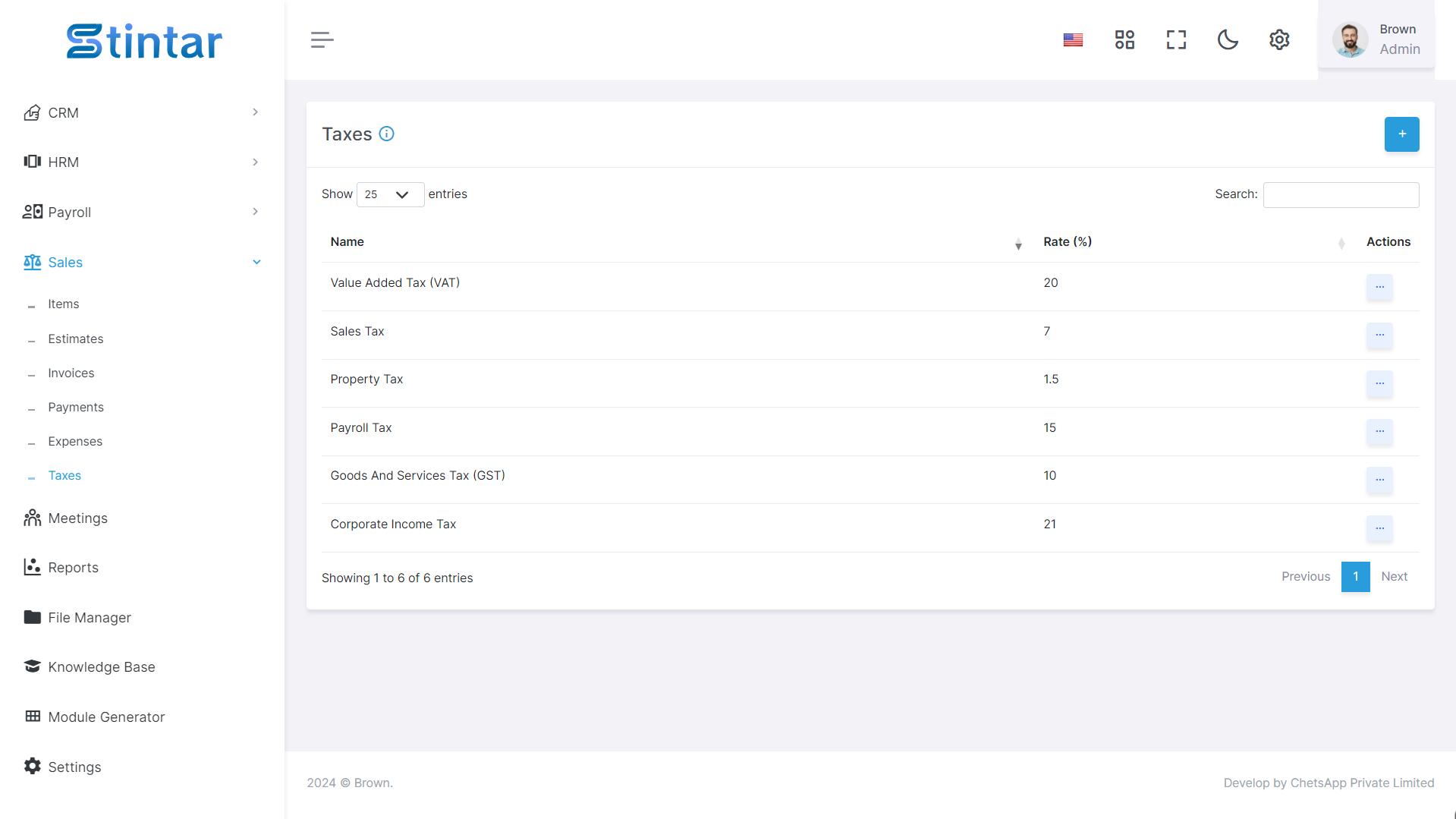

Viewing and Managing Taxes

Once saved, the tax will be listed in the tax listing page within the Sales Module.

From the tax listing page, you can view, edit, or delete tax details as needed.

Once saved, the tax will be listed in the tax listing page within the Sales Module.

From the tax listing page, you can view, edit, or delete tax details as needed.

Utilizing Tax Details

The tax details you create can be used in various modules within your system, including Conception & Costing, Items, Estimates, and Invoices.

When creating or editing items, estimates, or invoices, you can select the appropriate tax from the available tax options.

The tax details you create can be used in various modules within your system, including Conception & Costing, Items, Estimates, and Invoices.

When creating or editing items, estimates, or invoices, you can select the appropriate tax from the available tax options.

By following these straightforward steps, you can efficiently create taxes within your Sales Module. This process enables you to accurately apply taxes to transactions, ensuring compliance with tax regulations and facilitating seamless financial management across your organization.